The article posted by the famous magazine which

is Economist, (http://www.economist.com/blogs/freeexchange/2012/02/oil), discussed about the raises of oil price affected by either the low production of oil or sudden

growth of global demand for oil in America. The raises of oil price also

positively affect the firms’ quantity of labour demanded in the market. The

increases of oil price will increases the burden of American’s citizen income.

The first factor that increases the price of oil is

the high population in America. Nowadays, the quantity demanded for oil

increase because of the global population is increasing. The high population led

to high global demand for oil and result in the raises in oil price. This will

shift the oil demand curve in the market. From the figure 1, the equilibrium

price is $100 per barrel as well as equilibrium quantity of oil demanded is 18

million barrels per day. When the population in American increase, the demand

curve shifts rightward, while supply curve do not changes. The D* is the new

demand curve in the market. The shift of demand curve to the right shows the

increase in quantity demanded for oil from 18 to 19 million barrels per day. This

also increases the price of oil from $ 100 to $120 per barrel due to an old equilibrium

oil price shifts upward. Therefore, the population increase shift the demand

curve to the right results in the increasing of the quantity of oil demanded as

well as the raises in oil price.

The second factor that affects to price of oil is the

state of nature. Bad and dry weather causes the run dry of oil pipes in

American. This result in the supply of oil decreases. Since the low production of oil is occurred, the price

of oil tends to increase. In the law of change in supply, the supply of oil

decrease will increase the oil price. Meanwhile, the quantity of oil supplied

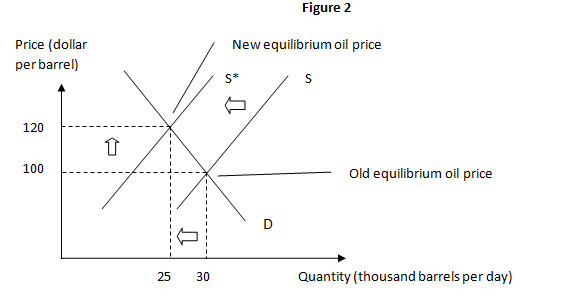

decreases in the market. From the figure 2 is showing that the supply of oil

curve will shift leftward because of the run dry of oil pipes. Normally, the

market equilibrium oil price is lies in $100 per barrel with the equilibrium

quantity of 30 thousand barrels per day. After the oil is running

dry in the oil pipes, the supply curve shift to the left because the natural

event decrease the oil production. Meanwhile, the new supply curve, S*, causes

the quantity of oil supplied decrease from 30 to 25 thousand barrels per day. Supply

curve shifts leftward along the demand curve causes the new equilibrium oil

price increase from $100 to $120 per barrel. Demand curve will not change in

this event. Hence, the supply of oil decreases due to the natural event

decrease the production of oil as well as increase the price of oil eventually.

In addition, the raise of oil price will not affect

much on the quantity demand for oil. According to the law of elasticity of

demand, quantity of oil demanded slightly decreases or increases, when the

price rises or falls due to the oil is a natural item. Therefore, the oil

demand curve is a highly inelastic demand but not perfectly. From the figure 3

demonstrates that the oil price raises up to $120 per barrel, but the quantity

demand just only drop by 1 thousand from 26 to 25 thousand barrel per day. Therefore, this graph shows the highly

inelastic demand for oil but not perfectly.

On the other hand, the raising of oil price is affecting

the firm’s quantity demand for labor in the market. The factor that increases

the firms’ quantity demand for labor is the price of the firms’ output

increases. In other words, the raise of oil price is the reason that firms

increase their quantity of labor demanded. This is because the raise of oil

price increases the value of marginal product of labor. For instances at the

beginning, a firm has 1 worker to produce 5 barrel of oil per day. If the firm

hires the second worker to produce 10 barrel of oil, thereby the marginal

produce of that worker is 5 barrel of oil. If the price of oil is $100 per

barrel, the value of marginal product is $500 which is $100 times 5 barrel of

marginal oil. Meanwhile, if the wage rate is $20 per day, the firm earns the

profit of $480 from the second worker.

In this case, when the oil price raise up to $120 per

barrel, the value of marginal product of the second worker is $600 ($120 times

5 barrel of marginal oil). Therefore, the firm gains the extra profit of $580

which computed by the value of marginal product of second worker ($600) minus

the wage rate of $20 per day for the second worker. When the firm earned extra

profit, it intends to hire additional labor to produce additional produce. This

brings the profit to that firm when the additional products is produced and

sell it with higher price.

I believe that the

raising of the oil price brings benefit to those who are facing unemployment. The

firms are willing to hire additional labor to produce additional products in

order to gain extra profit. The extra profits reduce the total cost of the firms;

thereby it is deserve to employ more workers in the production. Therefore, the

increasing of oil price result in the reducing in unemployment as well as

suppliers can earn the considerable profits.